· tax forms · 13 min read

Ultimate Guide to W2 and W3 Forms: Essential Tax Documents Made Simple

Master the world of W2 and W3 tax forms with our comprehensive guide. Learn everything from understanding their purpose to completing them accurately. Find the best forms for your business, ensuring seamless tax reporting.

The tax season can be a daunting time, but understanding and completing W2 and W3 forms doesn't have to be stressful. These essential documents play a crucial role in tax reporting for both employees and employers. In this guide, we'll delve into the purpose, significance, and proper completion of both W2 and W3 forms. Whether you're an employee, employer, or just need a clearer understanding of these forms, this guide has everything you need.

Overview

PROS

- Laser-printed, ensuring accuracy and clarity.

- Includes W-2 forms for 10 employees, eliminating the need for separate purchases.

- Self-seal envelopes streamline the mailing process.

- Economical value pack reduces expenses.

- Meets IRS specifications, ensuring compliance.

CONS

- Limited quantity may not be suitable for large businesses.

Streamline tax season with our comprehensive W-2 and W-3 forms kit, designed for businesses with up to 10 employees. These high-quality, laser-printed forms ensure accuracy and clarity, reducing the risk of errors. The included self-seal envelopes simplify the mailing process, saving you time and effort. This value pack not only saves you money but also eliminates the need for separate purchases of forms and envelopes.

Our W-2 and W-3 forms fully comply with IRS specifications, providing peace of mind that your tax reporting is accurate and compliant. The kit includes everything you need to complete your W-2 and W-3 reporting, maximizing efficiency and minimizing stress during the often-hectic tax season. Whether you're a small business owner or an individual managing your own taxes, our kit offers a convenient and economical solution for your tax filing needs. Invest in our W-2 and W-3 forms kit today and simplify your tax season with confidence.

PROS

- Designed for QuickBooks and Accounting Software

- IRS Approved

- Laser Forms for Crisp Printing

CONS

- Limited Quantity

- Requires Matching Envelopes

Filing your W-2 and W-3 forms just got easier with this convenient pack. These laser forms are designed to seamlessly integrate with QuickBooks and other accounting software, saving you time and hassle. IRS approval ensures compliance, giving you peace of mind during tax season.

With 10 forms included, you'll have enough to cover multiple employees or contractors. The laser printing technology produces sharp and professional-looking documents, making a great impression on recipients. However, it's important to note that this pack does not include matching envelopes, so you'll need to purchase those separately. Additionally, the limited quantity may not be suitable for businesses with a large number of employees.

PROS

- Versatile compatibility with QuickBooks and other software systems, streamlining your workflow.

- Pre-printed and IRS-compliant, reducing errors and expediting tax preparation.

- Ample quantity of 25 forms and self-seal envelopes, catering to small businesses and personal use.

CONS

- Limited to 25 employees, may require additional forms for larger organizations.

- Printing costs may be incurred if you do not have access to a printer.

Streamline your tax season with our expertly crafted W2 Forms 2023, designed to make reporting a breeze. These pre-printed, IRS-compliant forms ensure accuracy and efficiency, minimizing the hassle of manual preparation. The ample quantity of 25 forms and self-seal envelopes caters to the needs of small businesses and individuals alike, providing peace of mind during tax season.

Our W2 Forms seamlessly integrate with QuickBooks and various other software systems, allowing for effortless data transfer. This integration streamlines your workflow, eliminating the risk of errors and saving valuable time. The professional pre-printed format ensures that all necessary information is captured, reducing the risk of omissions or mistakes.

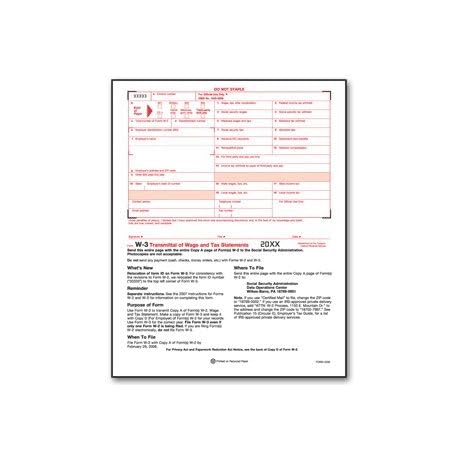

PROS

- Simplify wage and tax statement submissions with IRS-approved forms

- Expedite tax filing processes with laser-printed forms for enhanced clarity

CONS

- Limited quantity (pack of 25) may not suffice for large-scale operations

- Specific to 2023 tax year, requiring updates for subsequent years

Streamline your tax filing processes with the W3 Transmittal Tax Forms 2023. These IRS-approved forms provide a convenient and accurate way to transmit wage and tax statements to recipients. The laser-printed design ensures crisp and legible copies, eliminating the hassle of smudged or unclear submissions. The user-friendly format guides you through the necessary information, making it easy to complete your tax obligations efficiently.

Although the pack contains 25 forms, large-scale operations may require additional quantities. Moreover, these forms are specific to the 2023 tax year, so you'll need to procure updated versions for future filings. Nonetheless, for businesses and individuals seeking a reliable and time-saving tax statement solution, the W3 Transmittal Tax Forms 2023 offer an excellent choice.

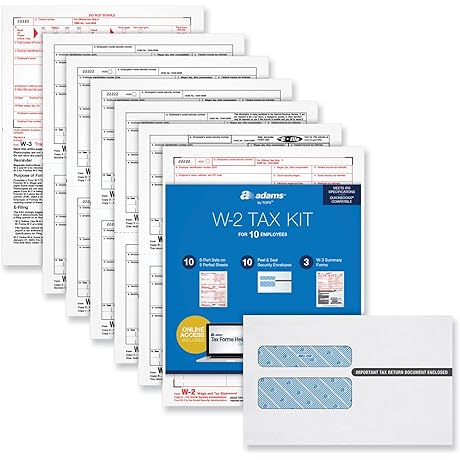

PROS

- Time-saving 6-part W2 forms

- Convenient W2 envelopes for secure mailing

CONS

- Limited quantity of W3 forms

- Instructions for filling out forms may be unclear

Enjoy simplified tax preparation with TOPS W2 Forms. This set of 26 forms and envelopes streamlines your tax reporting process, ensuring accuracy and organization. The 6-part forms provide ample space for employee information and tax calculations, reducing the likelihood of errors. Plus, the self-seal envelopes save you valuable time and effort during mailing.

While the kit conveniently includes 26 W2 forms and envelopes, the lack of additional W3 forms may be a limiting factor for larger businesses or those with complex tax situations. Additionally, some users have mentioned that the instructions for filling out the forms could be more explicit. Nevertheless, TOPS W2 Forms offer a practical and efficient solution for managing your W2 tax reporting needs.

PROS

- Simplify payroll reporting with laser-printed 6-part W2 forms.

- Complete W3 forms with accuracy, reducing hassle.

- Protect documents with self-seal envelopes for secure mailing.

- Receive guidance from Adams Tax Forms Helper Online for simplified tax preparation.

CONS

- May not be suitable for businesses with a large number of employees.

Adams W2 Forms 2020 Tax Kit simplifies tax reporting with a comprehensive kit that includes 6-part laser W2 forms for up to 12 employees. Each form is meticulously printed, ensuring accuracy and streamlining your payroll process. Additionally, W3 forms are included for complete employee information gathering.

To ensure secure and hassle-free mailing, Adams provides self-seal envelopes. The online tax helper from Adams offers valuable guidance throughout the tax preparation process. Whether you're an experienced tax preparer or navigating your first tax season, this kit empowers you with the tools and support you need to complete W2 and W3 forms efficiently.

PROS

- Organizes W2 and W3 forms for a seamless payroll process

- Facilitates quick and accurate preparation of tax documents

- Includes pre-addressed envelopes for hassle-free mailing

- Simplifies accounting and tax reporting

- Ideal for QuickBooks and other accounting software

CONS

- Some customers may prefer a digital format

Tax season just got easier with this comprehensive W2 Forms 2023 Income Set. Designed for businesses with up to 50 employees, this kit provides everything you need to efficiently handle your W2 and W3 reporting. Each set includes 6-part W2 forms that are laser-printed on high-quality paper, ensuring precision and clarity. The pre-addressed envelopes make mailing a breeze, saving you valuable time and effort.

Whether you're a small business owner or an accountant, this set is the perfect solution for your tax preparation needs. It seamlessly integrates with QuickBooks and other accounting software, guaranteeing effortless processing and accuracy. Investing in this kit not only streamlines your tax reporting but also ensures compliance and reduces the risk of errors. With its ease of use and comprehensive features, this W2 Forms 2023 Income Set is a must-have for any business looking to simplify payroll and tax season.

PROS

- Effortlessly complete your W-2 and W-3 tax reporting with Adams 6-Part Online Tax Kit.

- Each kit provides you with 10 forms, neatly organized into two-part sheets for your convenience.

- The forms are specially designed to comply with the latest IRS specifications for the 2022 tax year.

- The convenient carbonless design ensures clear and smudge-free copies.

- The kit's compact size makes it easy to store and access throughout the tax season.

- By utilizing Adams tax forms, you're guaranteed to meet all necessary IRS requirements.

CONS

- Additional forms may be required depending on the number of employees or income recipients.

- The kit does not include envelopes or mailing labels for sending out forms.

Streamline your tax reporting process with the Adams 2022 Payroll Tax Forms, W-2 Online & W-3 Online 6-Part Carbonless Kit. This comprehensive kit empowers you to seamlessly complete both W-2 and W-3 forms, ensuring accuracy and compliance with the latest IRS regulations for the 2022 tax year. With 10 forms meticulously organized into two-part sheets, you'll have ample supply to fulfill your reporting needs.

The kit's exceptional design prioritizes convenience and efficiency. The carbonless construction guarantees effortless and legible copies, eliminating the hassle of smudging or tearing. Additionally, the compact size of the kit facilitates storage and retrieval during the tax season. Whether you're a business owner or an individual managing personal finances, Adams tax forms provide a reliable and user-friendly solution for your tax reporting tasks.

PROS

- Convenient 6-part carbonless design simplifies tax preparation.

- Standard 5.5 x 8.5 inch size ensures compatibility with most software and printers.

CONS

- Limited quantity (24 W-2s and 1 W-3) may not be sufficient for large organizations.

The TOPS 6 Part Carbonless W2 & W3 Tax Forms are designed to streamline your tax preparation process. Featuring a convenient carbonless design, these forms simplify the completion and distribution of W2 and W3 documents. With 24 W-2s and 1 W-3 included, these forms are an ideal solution for individuals and small businesses.

Measuring 5.5 x 8.5 inches, these forms are compatible with most tax software and printers, ensuring ease of use. The carbonless construction eliminates the need for separate carbon paper, making preparation and handling more efficient. This set provides ample forms to meet your tax reporting needs, ensuring accuracy and compliance. Whether you're a self-employed individual or a small business owner, the TOPS 6 Part Carbonless W2 & W3 Tax Forms are an indispensable tool for managing your tax obligations.

PROS

- Precise laser printing ensures the correct and clear transfer of important tax information

- Can be produced and printed in-house, reducing the requirement for a third-party vendor

CONS

- May require a laser printer to function

The EGP IRS Approved Laser W-3 Tax Summary Form, Quantity 5, is an excellent option for businesses, accountants, and individuals seeking an accurate and efficient method for completing and printing W-3 forms. The high-quality laser printing technology produces sharp, legible copies, ensuring that information is conveyed accurately and minimizing errors. This can be a significant advantage compared to handwritten or dot-matrix printed forms, which can be more susceptible to smudging or illegibility which may hinder the information transfer and archiving process.

Another notable benefit of the EGP IRS Approved Laser W-3 Tax Summary Form, Quantity 5, is the in-house printing capability it offers. With this feature, you gain greater control over the production process, reducing the need to outsource tasks to third-party vendors. This can not only save on costs but also provide a greater level of security and confidentiality for your sensitive tax information. Additionally, this form can streamline your workflow and save you from potential delays associated with external printing services.

In summary, W2 and W3 forms are vital for accurate tax reporting and compliance. By familiarizing yourself with their key features and completing them promptly and accurately, you can ensure a smooth tax season. Remember to consult with a tax professional if you have any specific questions or require assistance with your tax obligations.

Frequently Asked Questions

What is the purpose of a W2 form?

A W2 form is used to report an employee's annual wages and taxes withheld to the IRS. It serves as a record of income and withholdings for both the employee and the employer.

Who is responsible for completing a W3 form?

The employer is responsible for completing and filing Form W3, which summarizes the total wages and taxes paid to all employees for the year.

What should I do if I lose my W2 form?

If you lose your W2 form, you can request a duplicate from your employer. You can also access it online through the IRS website if your employer has filed it electronically.

When is the deadline for filing W2 and W3 forms?

W2 forms must be filed with the Social Security Administration by the end of February, while W3 forms must be filed with the IRS by the end of March.

Where can I find the best W2 and W3 forms?

There are many reputable suppliers that offer high-quality W2 and W3 forms. Some popular options include Staples, Office Depot, and Amazon.